The forex market is a great way to make money, but it can be risky if you’re not careful. The required margin is one of the most important things to consider when trading in Forex. Further, we will explain how to calculate the required margin and avoid margin calls.

What is Margin?

Margin is the amount of money a trader must have in his trading account to open a position. This amount is a deposit that is required to cover any potential losses that may occur while trading. Margin is usually defined as a percentage of the total trading volume, and the broker sets it. Traders must read the relevant rules when registering. The total margin is 100% in Trendo Broker, and the trader can use all the free margin for trading. A 100% margin call occurs when the user has no more free margin for a new trade.

How to Calculate the Required Margin?

To calculate the required margin, you need to know the following:

- Position size or trading volume

- Leverage

- Margin percentage

Position size or trading volume refers to the total value of the position you want to open. Leverage is the factor that determines how much money you can control with a given amount of capital. Margin percentage is a percentage of the total trading volume you must have as collateral in your account to open a position.

The margin calculation formula is as follows:

Margin = (position size / leverage) x margin percentage

For example, let’s say you want to open a position with a position size of $100,000 and a leverage of 50:1. If the margin percentage is 2%, the required margin is calculated as follows:

Margin = (100000 / 50) * 0.02 = 40

That means you need to have $40 as a margin to open a position.

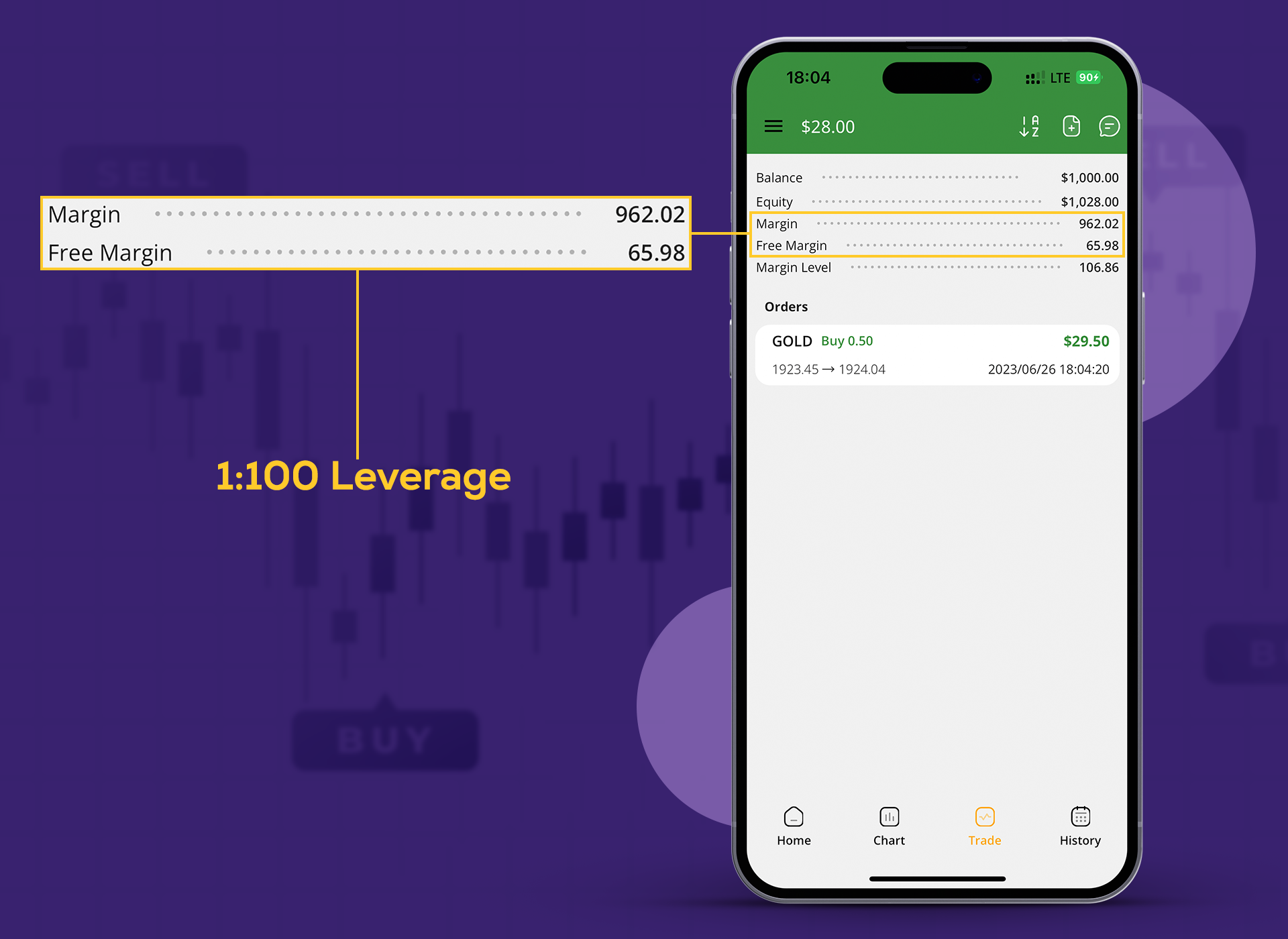

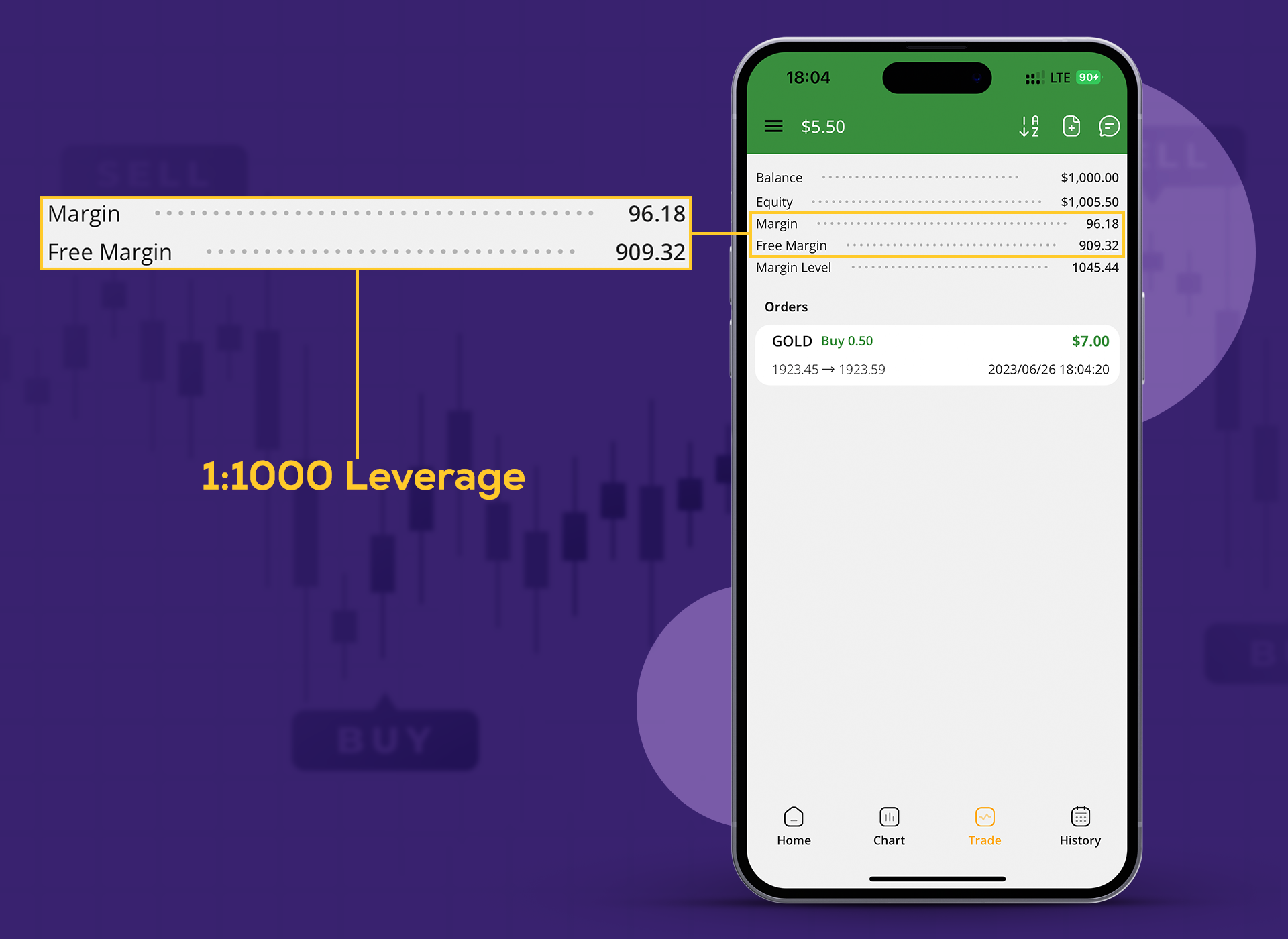

The relationship between margin and leverage is inverse, which means that if the account leverage is higher, less margin is needed to complete the trade. For example, Mark and Sam have an account in Trendo with $1000 in balance and $1000 in free margin. The difference is that Mark’s account’s margin is 1:100, Sam’s account’s margin is 1:1000, and they both intend to buy the EURUSD (Euro/Dollar) symbol. Mark’s account, which has a margin of 1:100, buys the Euro-dollar with a volume of 0.01 lot. He must give $10 of his free margin as a margin, but Sam, who has a margin of 1:1000, will only pay $1 of his free margin as a margin for every 0.01 lot of this symbol. Therefore, because Sam has higher leverage, he pays a lower margin for trading, as a result, he can make a higher trading volume compared to Mark’s account.

Read More: What is margin in forex?

Let’s continue with images in another example.

What is Margin Call & Stop Out?

Forex is a very volatile market, and if you are not careful you can easily get caught in margin calls. A margin call occurs when you have less account balance than the required margin level and are asked to deposit more money to maintain your open position. A margin call occurs when the loss of trades in the user’s or trader’s account is higher than the margin call level. In such cases, the user cannot open a new transaction because he has no free margin or enough balance and will face the “You don’t have enough money” warning. Simply put, a margin call is when the trader cannot open a new trade due to insufficient stock.

When the user’s trades lose so much that the stop-out level of the user’s account activates, the broker will automatically close the trade or open trades of the user with the most loss, to prevent the user’s balance from becoming negative.

The stop-out level is a level that if the loss of the user’s trades exceeds a certain percentage of the inventory or balance, the user’s stop-out will be activated and the broker will start to close the trade or trades that have the most losses so that the user’s total loss is less than the stop out level. In other words, the balance of the user’s account should not be less than a certain percentage of the balance, otherwise, the user’s stop-out will activate. In different brokers, the stop-out ratio can differ and is set according to the brokers’ rules, and every trader should learn these rules.

Many users, due to insufficient knowledge, call the stop-out mode a margin call and think that the margin call is such that the user’s trades are closed in that state; however, this is not true, and the margin call is a warning that the user is not allowed to open a new trade due to the high loss of the current transactions. But by adding new capital (top-upping the account) or closing your trading positions, you can increase your current balance ratio and account margin for new trades. The stop-out is a step after the margin call, in which the trader’s loss amount is so high that the broker automatically closes the transactions to prevent the account from becoming zero or negative. So, if you avoid margin calls, have you also avoided stop-outs?

Read More: Learn more about Margin Call and Stop Out in Forex and its conditions in Trendo

How to Avoid Margin Call in Forex?

Margin call conditions can be a stressful and costly experience for traders, but there are steps you can take to avoid margin calls:

1- Set an appropriate stop-loss order

The first step to avoid margin calls is to set an appropriate stop-loss order for each open position. A stop-loss order is an instruction for your broker to close your position if the currency pair’s price reaches a certain level or price. That will help limit your losses if the market moves against your analysis. But if you do not use stop loss in your trades, the loss of a trade may increase, and hoping that the price will return and you will be able to exit the transaction without loss, you will close your position at a loss only when the trade loss becomes so high that you are stressed And your trading account will be margin called.

Read More: What is Stop Loss? (Importance & key points of Stop Loss in trading)

2- Use the right leverage

Leverage is a double-edged sword in Forex trading. While it can increase your potential profits, it can also increase your losses. Using the appropriate leverage for each position to avoid margin calls is crucial. The amount of leverage you use depends on your trading strategy and risk tolerance.

Let’s see why high leverage can cause a margin call. When a trader uses higher leverage, it means you can do more transactions with a higher volume. As a result, when the size or trading volume increases, it means that the risk of trades increases, in other words, the possibility of more profit or more loss increases. Therefore, it is possible that a trader uses high leverage and has a high trading volume, as a result, if he does a transaction without a stop-loss, he may lose margin very quickly.

Read More: What is Leverage in Forex? (Trade more than your capital with leverage)

3- Check your account balance

Regularly monitoring your account balance is one of the most important things you can do to avoid margin calls. That will help you keep track of your open positions and ensure you have enough margin to maintain them. Many brokers offer online account monitoring tools that allow you to track your account balance, open positions, and margin requirements. Regularly using these tools is essential to avoid surprises or unexpected margin calls. To control your account balance, the most significant tool that a broker can provide to traders is quick and instant deposit and withdrawal. Trendo Broker has provided traders with various deposit and withdrawal methods, most of which are instant so users can top-up their accounts as quickly as possible.

4- Diversify your positions

Another way to reduce margin call risk is to diversify your positions. That means trading multiple currency pairs instead of putting all your capital in one position. Diversification can help spread your risk across different currency pairs and reduce the impact of any losses on your overall account balance. However, it is significant to remember that diversification does not guarantee profits or protection against losses.

5- Avoid trading during news release

Trading during news releases can be risky and increase the likelihood of a margin call. News releases can cause sudden and unpredictable fluctuations in the forex market, which may lead to significant losses. We recommend avoiding trading during important news releases, such as the non-farm employment report, inflation report, and interest rate decisions.

Read More: Economic calendar in Forex (how to use the economic calendar)

Summary

Avoiding margin calls in Forex requires understanding margin requirements, maintaining adequate margins, using stop-loss orders, monitoring trades, and avoiding trading during news releases. It is important to remember that forex trading involves a certain level of risk, and managing this risk is essential to protect your capital. By following these tips, you can reduce the margin call risk and increase your chances of success in the forex market.